Sem categoria

Cash Splash 5 Reel

junho 23, 2025 - Sem categoria

If you need to fill a funding gap between your school can cost you as well as your government assistance, following individual figuratively speaking could be the proper service. But using their generally high interest rates and you can shortage of borrower protections, it constantly is reasonable to help you fatigue government education loan possibilities prior to turning to private loan providers. In order to qualify, a debtor need to be a good You.S. citizen and other eligible condition and you can satisfy financial underwriting standards. The brand new debtor must satisfy relevant underwriting standards centered on specific bank requirements. Splash doesn’t make certain that you will get any financing also provides or that your loan application might possibly be approved. In the event the approved, the actual rate was inside various rates and is dependent upon multiple points, and label away from loan, a responsible financial history, income or other issues.

Pay day lenders and money advance software explore a number of trick pieces of info to approve your to own a pay day loan on the web or a cash loan. Life paycheck to paycheck is difficult enough instead of pricey issues arising. If you’ve sick any other borrowing from the bank alternatives, the last option will be a payday advance loan otherwise pay-day cash advance.

Just how much tend to a $20,one hundred thousand loan rates?

After you are prequalified with some lenders, evaluate personal loan costs and charge to discover the best render. For example, personal loan term lengths essentially cover anything from 1 so you can 7 ages, even when which may vary by bank. Consider your fees element as well as the day expected to repay the borrowed funds to help you slim your pursuit. Some of the credit card also provides that seem on this site are from creditors where i discover monetary settlement. So it settlement could possibly get impact how and you will where points appear on it webpages (in addition to, such, the order in which they appear).

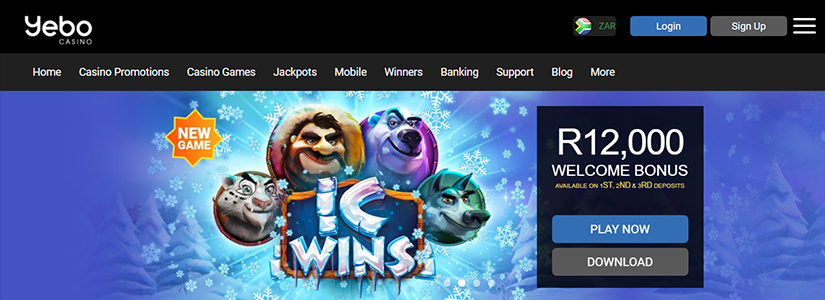

Find out about incentives given by CashSplash Local casino

Personal loans are fees fund giving you having a lump sum of money, generally inside times of implementing (some loan providers give same-date personal loans). Most of the time they’lso are unsecured, however loan providers do offer equity financing, and therefore encompass your pledging a secured asset to help you secure the financing. You’ll tend to should make so it percentage while the a lump sum otherwise, at the most, throughout one year.

Inside Bucks mr. bet Splash, the brand new progressive jackpot is actually caused by getting 5 crazy signs (Dollars Splash symbolization) for the 15th payline of the game. It blend of profits and you may vintage icons can make Dollars Splash an excellent amazing slot to have professionals looking both frequent victories and you can a great test during the jackpot. The brand new symbols to your reels follow an old casino slot games design, but every one possesses its own novel payout prospective.

Your loan solution could be prepared to undertake money you to definitely waives a lot of the fines and fees, leaving you along with your basic interest and you may fees to invest. You’ll should also has some other education loan so you can combine the defaulted financing. If the defaulted education loan is the one you have got, you obtained’t qualify for a combination mortgage. Their federal Direct Consolidation Mortgage are certain to get mortgage loan one to’s an average of their former finance.

Your safe a loan having collateral, that could and make it easier to be considered otherwise decrease your speed. Refinancing or merging private and you may government college loans may not be the right decision for all. Just before getting a private student loan as a result of Splash, you need to remark your entire options.

Prequalification isn’t a deal of borrowing, and your latest price can vary. You should be willing to wait a few days discover your finances, because the funding can take 3 to 5 weeks after accepted. Happy Currency have an a+ rating to the Bbb which can be best for debt consolidating and you may credit card consolidation fund. This informative guide explores exactly what qualifies while the a personal education loan, exactly how personal student loans functions, and in case to consider that it financing type of.

That it deposit bonus from CashSplash Gambling enterprise provides a wagering requirement of 40-times the value of their added bonus. In order to withdraw your profits, you ought to bet at the very least so it amount of money. For instance, if one makes a real money put well worth €100, you will discover a complement bonus out of €150.

If you are personal education loan interest levels are greater than those individuals from federal college loans, you might be eligible for straight down prices when you have expert borrowing from the bank. Private student education loans do not have the dependent-inside the debtor defenses of government student loans. Simultaneously, for consumers instead excellent credit, private student education loans tend to have large rates of interest than simply federal college loans, which leads to increased overall cost from credit.

- You may also qualify for government gives, including the Pell Offer, when you are an enthusiastic undergraduate scholar having outstanding financial you need.

- We’re clear about how exactly we could give quality content, aggressive rates, and you may useful equipment to you personally by the outlining how we return.

- Pay day loan and you will charge card dollars advantages are a couple of form of high-interest loans to prevent.

- Accomplish that to your record code that has been provided for your because of the current email address in your shipping confirmation and beginning information of Splash trends on line.

Without the loan providers offer finance so you can borrowers which have less than perfect credit, those that do tend to make it more convenient for consumers to get approved from the provided things beyond a credit rating. Twenty-year mortgages usually have straight down rates than simply 31-season finance. A good $325,100000 real estate loan at the six.25% would have a payment per month away from $2,376. The new prolonged the loan label, more the rate of interest has an effect on the percentage matter. A great $300,000 loan with an excellent six.5% financial rate could have a fees away from $step one,896. A speed decrease of 0.fifty percentage issues, in order to 6%, decreases the payment per month so you can $1,799.

To help you be eligible for federal student loans, you will need to complete the Free Software to possess Federal College student Help (FAFSA). This type find your qualifications not just to possess student loans however, but in addition for has, scholarships and grants, and the federal work-research program. From the adding over the desired payment per month, you’ll be able to decrease your loan harmony quicker and spend smaller desire more than date. Consider putting any unanticipated financing — for example tax refunds, bonuses, or monetary gift ideas — on the the student loan equilibrium. If you are planning to pay off their college loans very early, an incentives declaration is essential. It offers a very clear and precise count necessary to completely accept your debt, as well as focus and you can one costs.

That is best hinges on what you could qualify for, the cost of the applying, for which you buy it, and the monthly payment you can afford. Generally, these types of prices try lower than those people offered because of individual student loans. Refinancing is also an option to get rid of monthly payments and you will total credit can cost you if you’re able to lower your interest. However, really individuals with government money, in addition to Head Fund and FFEL program financing, ought not to refinance, as the doing this setting letting go of federal loan professionals. You can find four earnings-driven cost (IDR) agreements offered to Lead Financing individuals.

However, a reduced credit history get increase your prices while the loan providers come across your as more likely to default on the student loan personal debt. While you are accurate requirements are different because of the program, people potential can assist repay both federal and private figuratively speaking. To see what’s obtainable in your neighborhood, see your county’s Agency out of Degree webpages otherwise check with your elite connection. People that lent away from Sallie Mae next 2014 broke up provides private student loans, and this aren’t entitled to federal forgiveness apps. Yet not, Sallie Mae often launch bills for consumers whom perish or become entirely and you can permanently handicapped. Usually, the brand new centered-inside debtor defenses away from federal figuratively speaking make them a more glamorous alternative.